Protecting an Equity Loan: Steps and Requirements Explained

Protecting an Equity Loan: Steps and Requirements Explained

Blog Article

The Top Factors Why Property Owners Pick to Safeguard an Equity Loan

For several house owners, picking to secure an equity loan is a tactical financial choice that can supply different benefits. From combining financial debt to taking on significant home improvements, the factors driving individuals to opt for an equity car loan are diverse and impactful (Home Equity Loans).

Financial Debt Combination

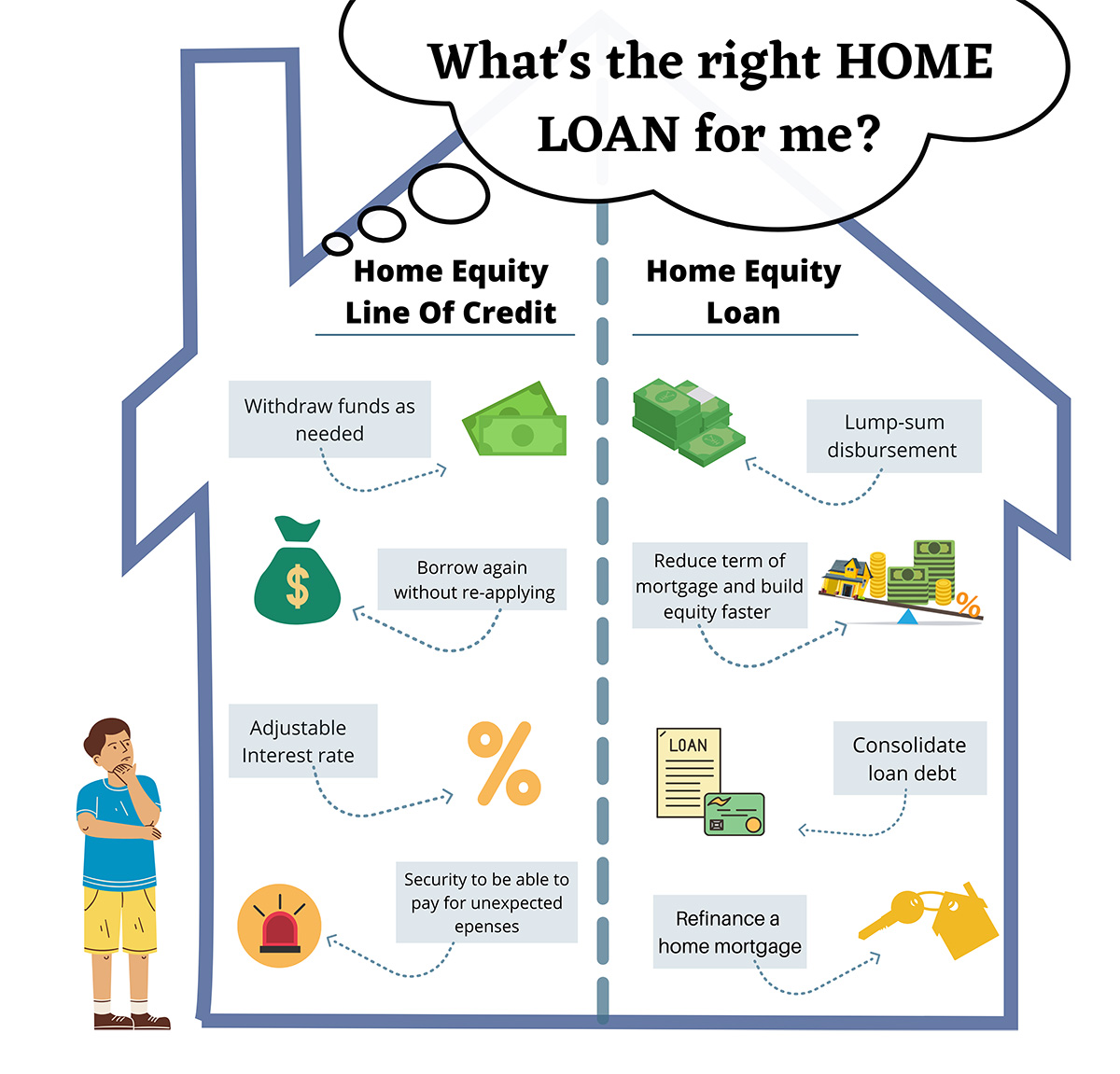

Home owners frequently go with protecting an equity lending as a calculated financial action for financial debt combination. By leveraging the equity in their homes, people can access a swelling amount of cash at a lower rate of interest compared to various other forms of loaning. This capital can then be made use of to repay high-interest financial obligations, such as credit score card equilibriums or personal car loans, permitting home owners to streamline their financial obligations right into a solitary, extra manageable regular monthly settlement.

Debt loan consolidation with an equity car loan can provide numerous advantages to house owners. To start with, it streamlines the payment procedure by combining multiple financial obligations right into one, lowering the danger of missed out on settlements and potential charges. Second of all, the lower rates of interest connected with equity fundings can lead to substantial price savings gradually. Additionally, consolidating financial obligation in this fashion can enhance an individual's credit history by reducing their overall debt-to-income ratio.

Home Enhancement Projects

Taking into consideration the improved worth and performance that can be achieved through leveraging equity, several individuals opt to assign funds towards numerous home improvement projects - Alpine Credits Equity Loans. Homeowners usually choose to protect an equity finance specifically for remodeling their homes due to the significant rois that such jobs can bring. Whether it's upgrading outdated features, increasing living spaces, or enhancing power effectiveness, home improvements can not only make living spaces extra comfortable however likewise raise the overall value of the residential property

Usual home enhancement jobs moneyed via equity fundings consist of kitchen remodels, washroom renovations, cellar finishing, and landscaping upgrades. These projects not just boost the quality of life for home owners but likewise contribute to boosting the visual allure and resale worth of the residential or commercial property. In addition, purchasing high-grade materials and modern design elements can even more elevate the aesthetic appeal and performance of the home. By leveraging equity for home improvement tasks, homeowners can produce rooms that better match their requirements and preferences while additionally making a sound monetary investment in their building.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Emergency Expenses

In unforeseen circumstances where immediate financial aid is called for, protecting an equity loan can give house owners with a sensible remedy for covering emergency situation expenditures. When unexpected events such as medical emergency situations, urgent home repair work, or unexpected task loss occur, having accessibility to funds with an equity car loan can provide a safeguard for home owners. Unlike other types of borrowing, equity fundings usually have lower rates of interest and longer settlement terms, making them an economical alternative for addressing prompt financial demands.

One of the essential benefits of utilizing an equity loan for emergency situation expenses is the speed at which funds can be accessed - Alpine Credits copyright. Home owners can swiftly use the equity accumulated in their home, permitting them to address pushing monetary problems right away. Furthermore, the versatility of equity car loans allows house owners to borrow only what they require, staying clear of the worry of handling excessive financial debt

Education And Learning Funding

In the middle of the search of college, safeguarding an equity financing can act as a tactical funds for homeowners. Education funding is a substantial worry for many family members, and leveraging the equity in their homes can give a way to access necessary funds. Equity loans commonly offer lower rates of interest compared to various other forms of financing, making them an attractive option for funding education expenses.

By taking advantage of the equity developed in their homes, home owners can access considerable amounts of cash to cover tuition charges, books, accommodation, and various other associated prices. Equity Loans. This can be specifically helpful for moms and dads seeking to sustain their kids with university or people looking for to further their own education. Furthermore, the passion paid on equity finances might be tax-deductible, providing potential financial benefits for debtors

Eventually, making use of an equity finance for education funding can help people purchase their future earning possibility and occupation improvement while effectively handling their monetary responsibilities.

Financial Investment Opportunities

Final Thought

To conclude, home owners choose to protect an equity loan for different factors such as financial obligation loan consolidation, home renovation jobs, emergency situation expenses, education financing, and financial investment opportunities. These finances provide a method for house owners to accessibility funds for important monetary demands and objectives. By leveraging the equity in their homes, homeowners can make the most of reduced passion prices and flexible repayment terms to accomplish their monetary objectives.

Report this page